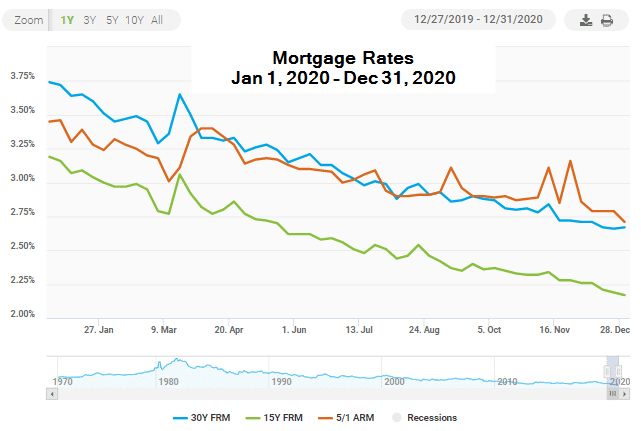

“Rates are at historic lows” is a song set to repeat for the last several years. Skeptics say it’s a marketing slogan mortgage lenders cling to. Statisticians prove its a statement of fact. Ultimately, 2021 is likely to resemble 2020’s amazing mortgage rate run.

Home Loan Rates Loved 2020

While commercials of the Devil dating the year 2020 resonate with us all, the year was conversely positive for mortgage rates. In fact, 2020 epitomized why the most popular answer to “What do you think rates will do next year Mr. Lender?” begins with “Well, I don’t have a crystal ball but….” 2020 was filled with never before seen circumstances shaping rate levels in ways no one predicted.

Much like other 21st Century disasters, COVID had that rare powerful combo of being unpredictable AND directly hitting mortgage rate fundamentals. Such powerful punches often immediately impact rate levels while also forever altering the underlying dynamics behind them.

When the Going Gets Tough, Rates Drop

Mortgage rates tend to benefit from disaster. It’s like the friend who is only happy when things are bad. After COVID, businesses shuttered worldwide due to one undisputed cause. However, mortgage rates steadily glided to new lows throughout 2020 amidst the turmoil.

This “immunity” exists for rates only because of the government’s help. To prevent added layers of chaos in our financial markets, the US Government intervened like they were Batman seeing his beacon shining high above Gotham.

The economic fallout COVID inspired foreclosures and high mortgage rates jump stopping the housing market into a face plant would create would be exponentially costly. In a sort of Prevent Defense formation, The Fed used tools such as Quantitative Easing to guide mortgage rates to record lows preventing said face plant. Imagine the flip side of this action. If rates were left to run wild – how much deeper would COVID’s cut have gone in 2020 and beyond?

2021 Mortgage Rates

Saying “mortgage rates are safely low until COVID is in the rearview mirror” sounds simplistic. However, it’s the best way to explain what to expect in 2021. Remember, the powerful hand of the Fed is firmly holding down the Nations “keep rates low” button. It’s there on purpose as a central part of their “further devastation prevention plan” – a follow up plan proven to work with other 21st Century iterations of disaster.

To test this idea, just recap the past several months. First, we had arguably the most “unique” Presidential election in history – yet no impact on rates. Second, insanely bad jobs data woven like a candy cane with intermittent positive employment numbers also failed to shake rates loose from current record low levels. Both, in any other environment directly influence rates and likely do so on a massive scale.

Our Fed is smart and transparent. Both help predict low mortgage rates are here until COVID’s ugly grip on our world has slipped away. In fact tracking COVID’s impact on our economy is also the best way to pick a horse in the interest rate race right now. For now my horse is “Layin Low” and 2021 looks strong.