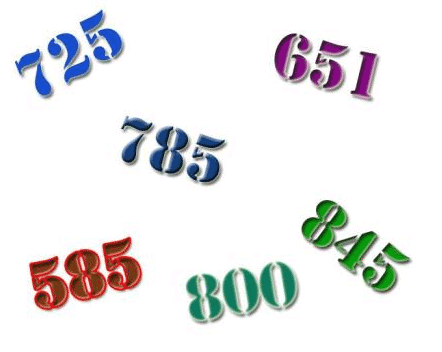

Credit score is not only a point of pride but is also a pivotal factor for each and every Arizona home-buyer.

Continue reading

Arizona Mortgage Lender | The HOUSE Team

Lender offering FHA, VA, Conventional and JUMBO mortgages | Top 1% Loan Officer Nationally (Mortgage Executive Magazine)

Credit score is not only a point of pride but is also a pivotal factor for each and every Arizona home-buyer.

Continue reading

Everyone knows credit is key and it impacts your Arizona home loan approval. Your Arizona mortgage lender pulls a tri-merge (all

Continue reading