When applying for a home loan, Arizona loan officers often take a minimalist’s approach with your income. In other words, they

Continue reading

Arizona Mortgage Lender | The HOUSE Team

Lender offering FHA, VA, Conventional and JUMBO mortgages | Top 1% Loan Officer Nationally (Mortgage Executive Magazine)

When applying for a home loan, Arizona loan officers often take a minimalist’s approach with your income. In other words, they

Continue reading

Arizona mortgage applicants for the most part know getting a new car loan is a “no-no” during the home loan

Continue reading

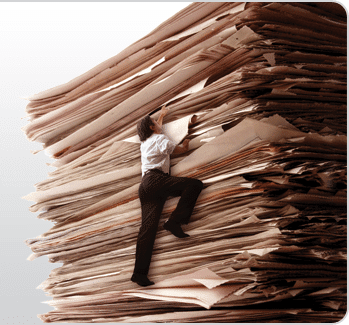

Documenting deposits ranks as a major pain in the neck for home loan applicants. In fact, “my mortgage lender needed everything

Continue reading

Home Loan rules have change from the past both for Arizona Mortgage Lender’s and for mortgage companies across the country.

Continue reading

Part 5 of 5 | Reasons for Mortgage Pre-Approval See the rest of the series. Reason #1: Income for Approval Income

Continue reading