The Feds 2018 Interest Rate Hikes are now a trio. On Wednesday September 26 The Fed hiked rates for the 3rd time in 2018. While on the surface this may be frightening, digging deeper reveals the method behind the Fed hike madness. In fact, you might even find comfort after knowing the Fed’s reasons for hiking rates.

Apply for a Home Loan

Team@JeremyHouse.com

602.435.2149

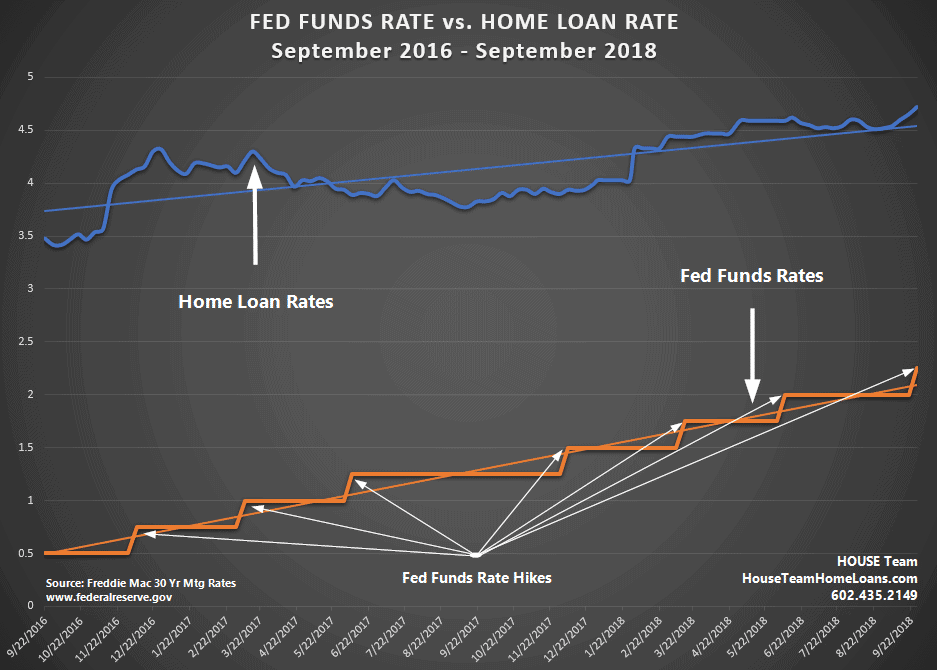

Home Loan Interest Rates vs. Fed Funds Rates

While home loan rates and the Fed Funds Rate do not move in tandem, a long term correlation exists. For example, over the past 2 years these rates have each increased similarly.

- Fed Funds Rate +1.75%

- Home Loan Rates +.1.24%

(Source Freddie Mac 30 Year Fixed Rates & FederalReserve.gov)

It is possible the real conern is we have been spoiled for far too long and not the hikes themselves. Normal rates look and feel high when our norm has been excessive abnormally low rates. Adjustment periods being uncomfortable makes sense. However, does it mean they are bad or unnecessary?

Future Fed Fund Interest Rate Hikes

Considering the feedback provided by the Fed, we appear to be in the early to mid stage of this rate hike cycle. Currently, 12 of 16 Fed Board Members expect one more rate hike in 2018. In addition, expect more hikes into 2019 and beyond. Much could change that plan in the interim however, planning on 2-3 more years of Fed Funds Rate hikes seems appropriate.

Why Hike Fed Fund Interest Rates?

The Fed hikes are because the US economy is strong (good growth, low unemployment etc…). Hike opponents believe hiking too fast and far stifles the growth we are seeing (near 3% annual economic growth). Personally, to hike or not to hike is a job I am not upset is not mine.

Apply for a Home Loan

Team@JeremyHouse.com

602.435.2149

Fed Fund Interest Rates Hikes Direct Impact

Perhaps it is the phenomenon known as reticular activation however, the major concern birthed by rate hikes is home loan rates are going to sky rocket. While there is an undeniable indirect relationship between Home Loan and Fed Funds Rates, the only rates directly impacted by the Fed Funds Rate are:

-

- Non Mortgage Bank Loans (auto, personal etc…)

- Credit Card Rates

- Adjustable Rate Mortgage Loan Rates

- Deposit Account Rates (ex: rate paid on your savings acct)

In fact, the above is not entirely true. The ONLY rate impacted by a Fed Funds Rate hike is the rate at which banks borrow money. However, banks pass this increased cost on directly to the consumer as described above. As you can see, Rate hikes are unavoidable but more importantly they are probably for the better in most cases.

By Jeremy House