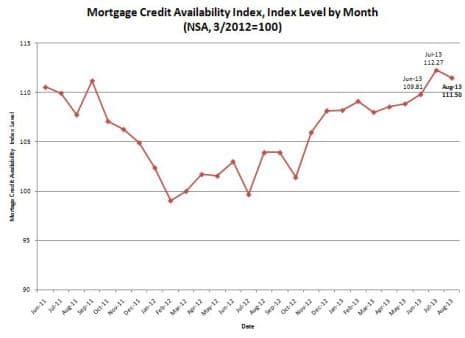

Just when you thought there was a measurement for everything the Mortgage Bankers Association (commonly known as the “MBA”) adds one more. The Mortgage Credit Availability Index (The MCAI), quantitatively measures how hard or easy it is to obtain a mortgage in the US. For example, this index, like most indices, uses 100.00 as its base. The higher the index the easier it is to get a mortgage. Conversely, the lower the index the tougher it is to get a mortgage.

For example, the MCAI indicates the ease of getting a mortgage. The MCAI is directly impacted by investors in the mortgage market. As a matter of fact, investors are responsible for supplying mortgage companies with mortgage money. They also dictate mortgage guidelines. Arizona mortgage guidelines are always changing. The results are subtle changes ranging all the way to complete shifts in mortgage rules. Mortgage rule adjustments can make it harder or easier for a home loan to get through underwriting.

Apply for a Home Loan

Team@JeremyHouse.com

602.435.2149

Calculating How Hard it is to Get a Mortgage?

There are several factors that go into the MCAI. The primary categories include:

1. Loan Purpose (Purchase, rate/term refi or cash out refi)

2. Amortization type (Fixed, ARM or balloon)

3. Property type (Primary residence, second home or investment property)

4. Loan term (years to maturity)

5. Loan to value

6. Document type (fully documented, stated or no-doc)

7. Payment type (Interest-only or principal and interest)

Unfortunately, the exact calculations used by the indexes are not public knowledge. In conclusion, this index’s purpose is to quantify the level of difficulty in getting a mortgage. In light of the data continually changing, it is tracked and compared monthly.

Quantitative or Qualitative: What’s a Better Gauge?

Currently there are 2 primary gauges to measure the difficulty in obtaining a new mortgage. For instance, the MCAI, is purely Quantitative; all facts and figures. The second gauge is the Federal Reserve Board’s qualitative “Senior Loan Officer Survey on Lending Standards.” This report also measures how tough or simple getting a loan has become. The results, however, are generated from the subjective opinions of Sr. loan officers throughout the US. The Fed interviews experienced mortgage professionals throughout the country to measure if loan approvals are getting tougher or easier.

While both reports have their merits, I tend to lean toward the Feds qualitative measurement. The Fed, as well as loan officers, have direct insight into the industry and to underwriter guidelines. We also see how underwriters on the ground level are responding to various circumstances on actual files. In reality, we see first hand how guidelines are evolving month to month and the changes are rarely as black and white as a set of numbers.

By Jeremy House

Google