What’s the difference between a boxing match and mortgage rates? In boxing, a ref stops the fight when a boxer is stumbling. Has our ref come to throw in the towel on stumbling mortgage rates?

Ending the Rate Rising Trend?

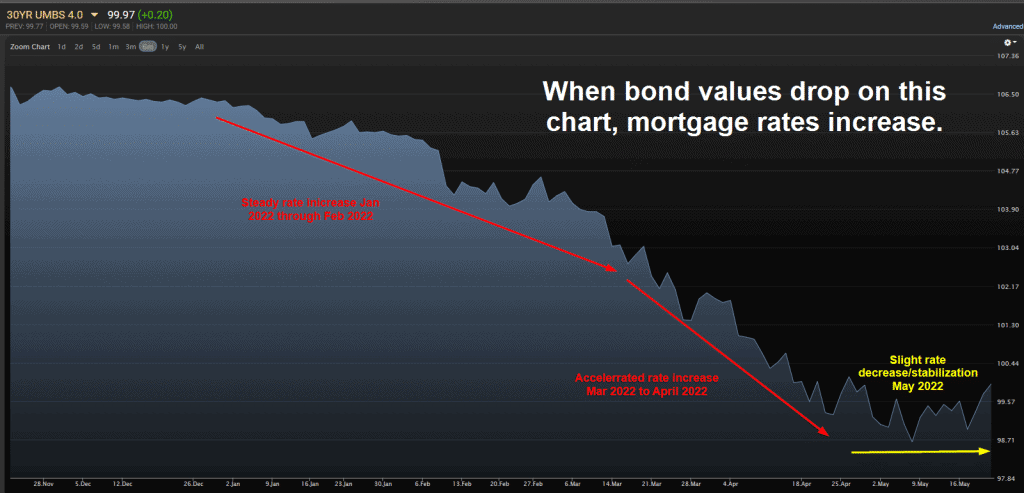

I type this while knocking on wood – 5/30/2022 ended the 2nd week in a row where rates were lower week over week (1st time this year). While the improvement is modest (about .25% lower in interest rate on average), a stabilization in rates may be developing. Hard to say. While rates remain historically “good”, a break from the volatility would help.

Below is a quick visual spanning 11/28/2022 to 5/20/2022. It shows bond prices during that time. Remember, bond prices move in the exact opposite direction mortgage rates do. One look tells the story!

More Time Will Tell if Mortgage Rates Improve

Mortgage rates cycle. For a period of time they are at one level, then for a period of time they fall or rise followed by another period of stabilization. Then its usually rinse, wash repeat over time again and again. With that in mind, the question is when does this current upward transition stop?

While not a simple question to answer, the best thing we can see is more days/weeks that match the past 14 days. It’s called a “sideways trend” meaning rates don’t increase or decrease. Right now, that would be a welcome reprieve from one of the most aggressive rate uptick trends in a long time.

What To Watch For?

Much of last weeks stability in rate came from the stock markets woes. The stock market health will be a factor to monitor. Rough seas in stocks could continue to help interest rates. Additionally, inflation is fundamental to mortgage rates direction. Watch inflation reports and listen to what the Fed says regarding inflation and policy decisions. If inflation tempers the chances for rate stability improve.