Home Loan rates are near the exceptionally low levels of the pre 2016 election. Back in 2016, mortgage rates began a long hike the morning after Trump was voted into office. November 8, 2016 marked the end of a low rate era. Wednesday November 9, 2016 marked the beginning of rates rising. 2019 is telling a different story.

Mortgage Rates Drop Pre-Election Levels of 2016

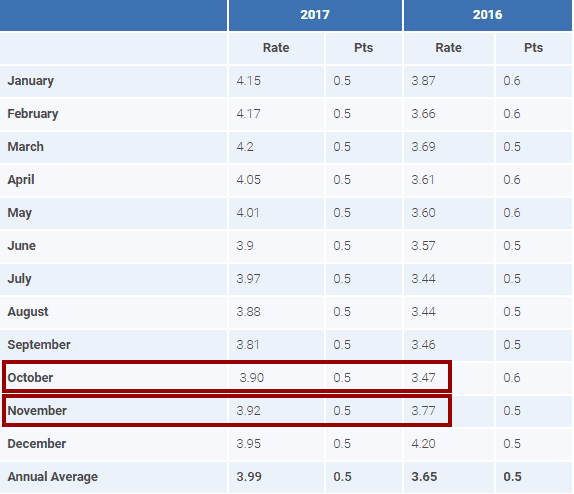

Mortgage Rates are now at, below or near low pre Trump Election Levels. Check out the table below from Freddie Mac to see Pre-Election 2016 rate changes. Interest rates departed the mid 3% range behind the morning after the election. Shortly thereafter they would nestle in comfortably at close to 5% in 2018.

Through 2017 rates stayed historically low but periodically high. The 3.81% to 4.2% range in 2017 according to Freddie Mac was capped by on again off again economic progress among other things. However, turn the page to 2018 and mortgage rate ranges increased to 4.03% to 4.87%.

2019 Low Mortgage Rates Spark Purchase and Refi Boom

Fast forward to Mid 2019 and rates have in some cases reverted to September 2016 levels. Many home-buyers and homeowners are leveraging the cheapest mortgage money in 2.5 years. Buying a home is now cheaper in many cases and refinancing can save hundreds!

There is no telling what the 2nd half of 2019 will hold for mortgage rates. Waiting to refinance speculating lower rates are to come often costs homeowner’s big time! The same is true for home-buyers except, home-buyers are rolling the dice with rates and home prices. If they get snake-eyes and both go up, the should, woulda, coulda regret rears its ugly head!

By Jeremy House