In December of 2015, the Fed did something they had not in nearly a decade – increase the Fed Funds Rate. The Fed bumped the Fed Funds Rate .25%. Fannie Mae and Freddie Mac do NOT go on hiking trips with the Fed. In other words, a Fed rate increase does not equal a mortgage rates increase. They may move together and they may. The real question is are they moving because of each other?

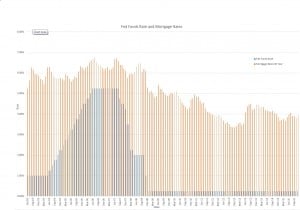

Below is a graph showing the history of the Fed Funds Rate and Mortgage Rates (per Freddie Mac). After the expected knee jerk response in mortgage rates (and stocks) post rate hike announcement, what matters is where rates are when the dust settles.

Comparing Fed Rate Hikes and Mortgage Rate Trends

When key dates from the graph below are compared, the correlation between the Fed Funds Rate (FFR) and 30 Year Fixed Mortgage Rates (Mtg) is revealed. During the hike cycle 2003 to 2007 the 2 rates did not move in tandem.

2003: FFR 1.0% (baseline) Mtg 5.23% (baseline)

Dec 2004: FFR 2.25% (UP) Mtg 5.75% (UP)

June 2005: FFR 3.25% (UP) Mtg 5.58% (DOWN)

Dec 2006: FFR 5.25% (UP) Mtg 6.14% (UP)

June 2008: FFR 2.0% (DOWN) Mtg 6.32% (UP)

Fed Funds Rates:BLUE

Mortgage Rates:RED

Start Date: June 2003

End Date: Nov 2015

Much More to Mortgage Rates

During the post 2008 era the Fed influenced the mortgage rate market with Quantitative Easing (QE). The moral of the story is there have been and will continue to be a multitude of factors that factor in to determining mortgage rates. For example, if mortgage rates climb due to economic factors, political factors etc… who is to say the Fed does not use something like their Quantitative Easing tools to keep rates and housing healthy? Fed Rates are not the primary force behind mortgage rates.

By Jeremy House

3 comments