When you think of a low down payment home loan chances are an FHA home loan is atop your list.

Continue reading

Arizona Mortgage Lender | The HOUSE Team

Lender offering FHA, VA, Conventional and JUMBO mortgages | Top 1% Loan Officer Nationally (Mortgage Executive Magazine)

When you think of a low down payment home loan chances are an FHA home loan is atop your list.

Continue reading

Have you filed your Federal Income taxes yet? The date an Arizona mortgage applicant files their taxes can be the

Continue reading

Often, VA buyers have trouble with loan approval on an Arizona VA mortgage. Seasoned loan officers use creative problem solving

Continue reading

Home Loan Underwriters have an important job. All mortgage processes lead to facing the almighty underwriter. Oftentimes, clients come to with stories

Continue reading

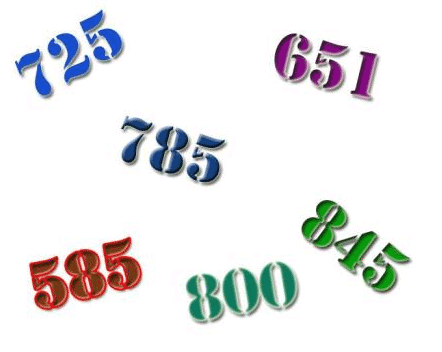

Everyone knows credit is key and it impacts your Arizona home loan approval. Your Arizona mortgage lender pulls a tri-merge (all

Continue reading