Mortgage Lenders qualify you using your gross income. Gross income equals your pay before taxes and other deductions come out.

Continue reading

Arizona Mortgage Lender | The HOUSE Team

Lender offering FHA, VA, Conventional and JUMBO mortgages | Top 1% Loan Officer Nationally (Mortgage Executive Magazine)

Mortgage Lenders qualify you using your gross income. Gross income equals your pay before taxes and other deductions come out.

Continue reading

When applying for a home loan, Arizona loan officers often take a minimalist’s approach with your income. In other words, they

Continue reading

With mortgage rates in flux, home-buyer’s and homeowner’s are looking for better options. Specifically, the lowest possible monthly mortgage payment

Continue reading

An Arizona Mortgage Pre-Qualification Form must be provided when submitting an offer to purchase home. The from validates that they are

Continue reading

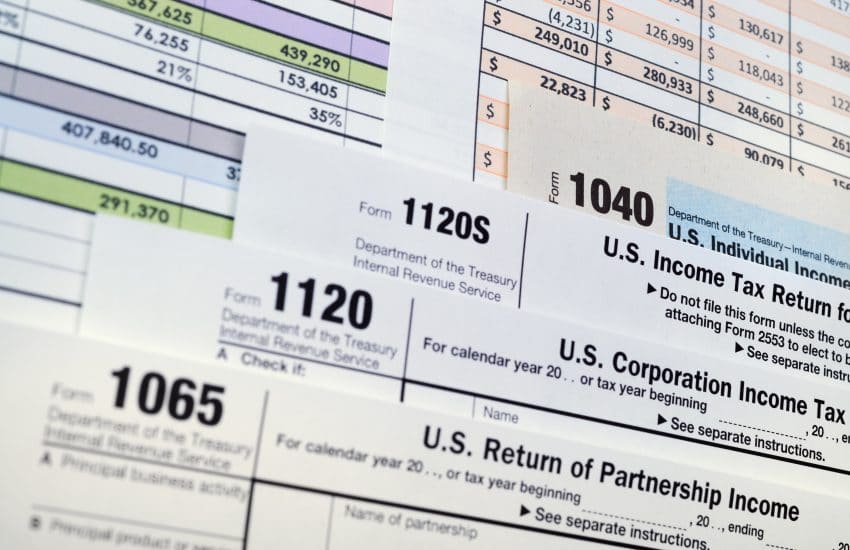

Door Opens Wider for Self-Employed Borrowers Self employed home-buyers expect to have a harder time with the Conventional Home Loan application process. Above all,

Continue reading