On June 13, 2018, The Fed Funds Rate was increased to 1.75% to 2.0% and The Fed promised to raise it 2 more times this year (Sept and Dec). If your clients are wondering how this impacts their home buying prospects the information below may be helpful.

Fed Funds Rate VS Home Loan Rates

The FED FUNDS RATE & HOME LOAN RATE connection is often misunderstood. In fact, many consumers hear “Feds hike rates” and assume mortgage rates are included.

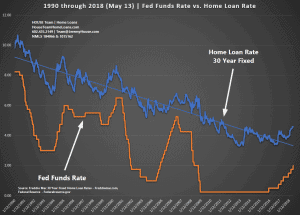

I put the chart below together showing the trend of both Home loan rates (blue) and the Fed Funds rate (Orange) since January of 1990 through present. The Fed Funds Rate history is as smooth as a new teenage driver in a 6 speed. The Home Loan rate history tracks more like a smooth sailing veteran.

2 things stand out when comparing these rates over time:

- HOME LOAN RATES and the FED FUNDS RATE do NOT rise and fall in unison

- 2001 to 2005: Fed Funds Rate dropped over 4% while Home loan rates fell roughly 1%

- 2005 to 2007: Fed Funds Rate increased around 4% while Home Loan rates went up by approximately .375%

- HOME LOAN RATES and the FED FUNDS RATE do trend together over long periods of time

- Jan 12, 1990 (the “start”): Fed Funds Rate was at 9.8% and Home Loan rates were at 8.25%

- June 13, 2018 (the “end”): Fed Funds Rate is at 1.75% to 2.0% (a 79% drop) while Home Loan rates are at 4.59% (a 44% drop)

The Fed raising the Fed Funds rate does not mean home loan rates will immediately follow suit. Thank you!

By Jeremy House