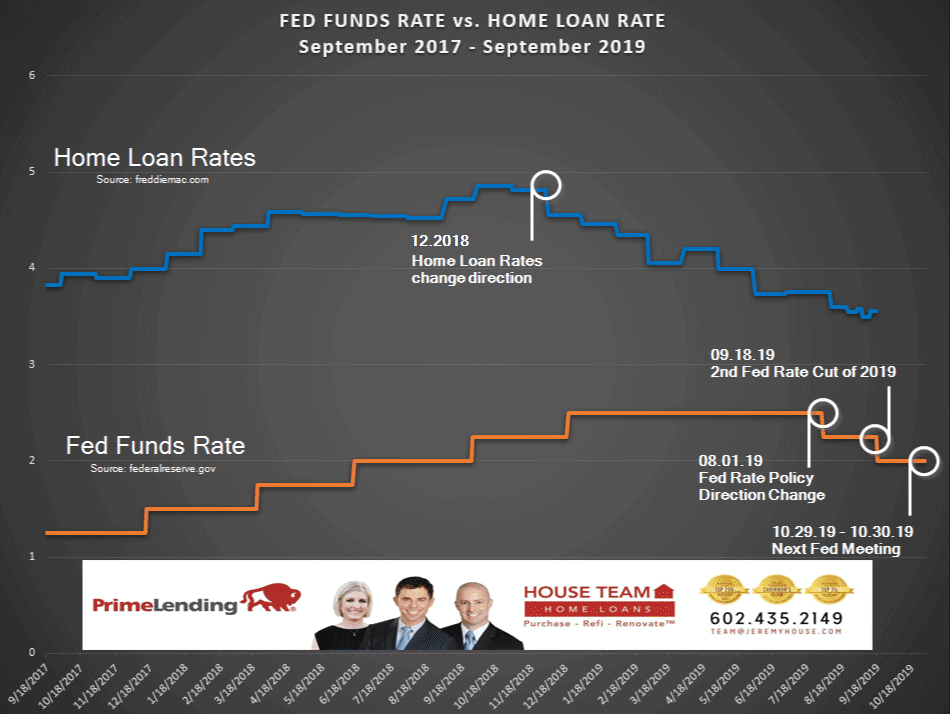

Are mortgage rates improving after the Fed’s 2nd Rate Cut in 2019? Hard to improve on an already great thing. However, extraordinary low home loan rates are in fact flirting with falling further post cut.

Fed Rate Cuts 1 and 2 – Insurance Cuts

The 2019 Fed Rate Cuts were “Insurance Cuts”. In other words, not super necessary cuts. At least not in the near term. The Fed Cut rates twice to put even more space between our current decent economy and a recession. Previous Fed Rate Cuts have commonly been surrounded by grave economic fears.

While Fed Rate Cuts are not tied to home loan rates), consider the relationship between them surrounding both 2019 Fed cuts. Home loan rates were relatively low prior to the cuts. In fact, mortgages rates were declining before and between the cuts. Predicting home loan rate reaction to these types of Fed Rate Cuts is at the very least a unique unprecedented task.

Home loan rates may respond to Fed Rate Cuts like a master limbo champion after trimming his eyebrows and not go much lower. However, it is possible to see rates dip down further and it all depends on so many tangential factors that predicting it is a day by day activity.

How Low Can Mortgage Rates Go?

As you can see, mortgage rates continue their steady descent which started right near the start of 2019. Depending on what resource used, the all time lowest 30 year fixed mortgage rate falls somewhere in the 3.375% range. Are we staged to see that again? While no one truly knows, right now the stage is set as best as it has been for some time to allow for such a drop.

By Jeremy House