Home loan rates hit historical lows in 2020 and maintained them through early 2021. Then, rates climbed upward in mid February 2021. However, a possible rebound back to lower rates appears possible after April 2021’s first full week.

Home Loan Rates Dropping Again?

Disclaimer to this entire article is this: home loan rates remain at excellent, very affordable low levels today even after rising a bit in 2021. With that out of the way, lets peek at what the chances of being grossly spoiled again looks like.

An untamed rate market as volatile as this one makes a rate soothsayer out of no-one. However, mortgage rate trends tend to follow some semblance of logic – even during illogical times. As a result, let’s glimpse at what could be a reversal of the past 2 month’s rising mortgage rates.

Rate Re-Rally Really Happening? 3 Key Time Periods:

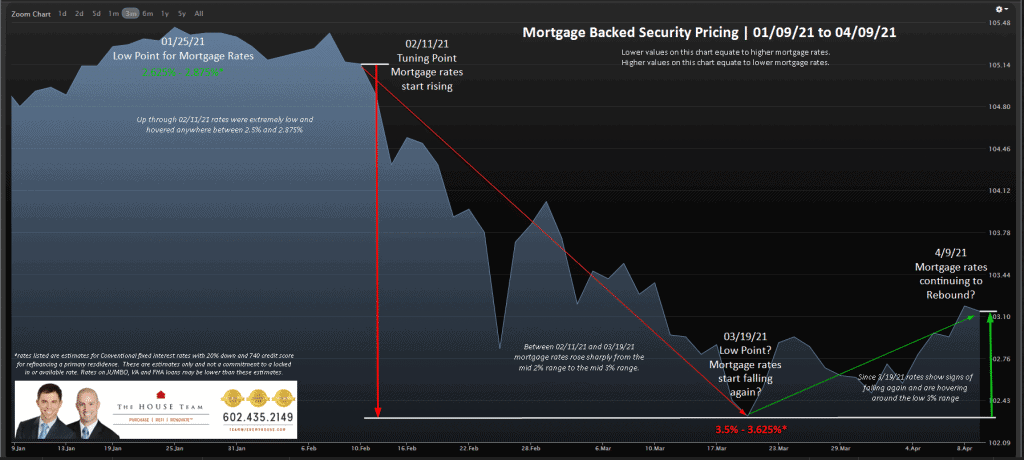

- Mid 2020 to 2/11/21 rates historically low

- 2/11/21 to 3/19/21 rates pivot and increase (still very low though)

- 3/19/21 to 4/9/21 possible rally period where rates dip back down

The chart below shows mortgage bond pricing. Rates go up when bond pricing goes down and when bond pricing goes up mortgage rates go down. In other words, the decent marked by the red arrows means home loan rates went up during that time period while the green arrows show a period where rates are dropping.

“What goes up, must come down” sort of applies to mortgage rates. Problem is, we don’t control the ups/downs. However, after the unusually quick rise in mortgage rates from February 11, 2021 and March 19, 2021 home loan rates appear to be rallying and possibly falling even lower again.

Beginning Of Return To Abnormal Lows?

Is March 19, 2021 the day early 2021’s rapid rate increases stopped and a rate rally began? Funny thing about rate trend changes – they are not obvious in present. They are however clear as day in hindsight. In other words, it’s too soon to tell if mortgage rates are going from the new but still very low levels back to the never before seen low levels we experienced for most of 2020.

While tracking this potential rally, remember that no market moves with linear beauty. Instead, they track like a line following someone scampering away from a buzzing bee. No straight line movement. However there tends to be aggregate movement in a general direction. We are seeing signs of such a trend shaping and this time back toward lower rates.

Time Tells All

Next week and the week after will fill out the shape and definition of this rally or…non-rally. Future Unemployment Rate and New Jobs reports certainly play a role here. Also, technical factors like moving averages, ceilings and floors can both contain or promote rate rallies.

Given the unknowns, best bet – be prepared. Know what might be coming. If you are looking to snatch a world record low interest rate – the second coming may be around the corner. Then again, if not today’s rates are still fantastically low and we are blessed to be in such a low rate environment.