Veterans can have more than one VA loan. In fact, there is no limit on the number of VA loans a veteran can have at a time. Instead, VA limits a veterans VA loans based on the Veterans entitlement.

Veterans Can Have More than One VA Home Loan

Veterans can have 2 VA home loans at the same time. The number of VA loans each veteran may have at the same time is based on the veteran’s remaining entitlement and NOT the number of VA loans under their name.

Many veterans believe they are limited to one VA loan at a time. However, VA is far more flexible in this area and allow for as many simultaneous VA loans as a veterans VA entitlement allows.

Phone: 602.435.2149

Email: Team@JeremyHouse.com

How to Qualify for More than one VA Mortgage

Imagine a veteran has a VA mortgage on a home already. This veteran is then relocated due to receiving new orders to a completely different state. As a result, they want to finance a new primary residence in the new state using their VA mortgage benefits again.

That veteran can tap into their bonus entitlement to finance their new home with a new VA mortgage. Assuming the veteran has sufficient bonus entitlement they would be eligible for a 2nd simultaneous VA mortgage. This is different from how FHA works. Learn more about having multiple FHA loans

Determining Eligibility for Multiple VA Loans

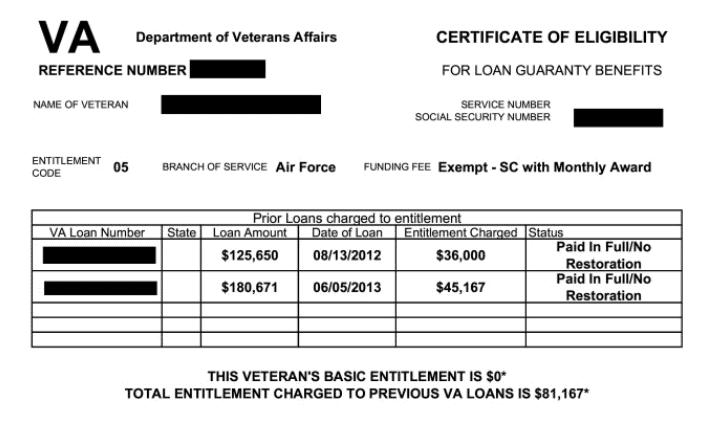

Eligibility for a simultaneous second VA mortgage is based on the veterans remaining entitlement. In order to determine eligibility for a second VA mortgage veterans should work with their mortgage lender. The mortgage lender obtains a copy of the veterans certificate of eligibility or “VA COE”. On that document, the entitlement charged to existing VA mortgages is listed.

Once the lender knows the entitlement charged AND they then find the current maximum conforming loan limit in the area the veteran is buying. Next, they determine the maximum amount for the subsequent and simultaneous VA loan the veteran qualifies for.

Minimum Loan Amount Required with Bonus Entitlement

VA requires a veteran finance a specific minimum loan when using bonus entitlement. In fact, an Arizona mortgage lender cannot originate a mortgage for less than $144,000 for veterans using VA bonus entitlement. Most borrower’s think of a maximum loan amount when they think about getting pre-approved. However, you also need to factor in the minimum $144,000 loan amount with bonus entitlement.

VA Entitlement Restoration vs. VA Bonus Entitlement

So far, we have addressed the a veteran having 2 VA mortgages at the same time or a veteran who has used their basic entitlement up due to foreclosure etc… Veterans that have had VA mortgages in the past but have paid them off will have fully restored their basic entitlement (unless other circumstances exist). A borrower applying for a subsequent Arizona VA mortgage will not need to use bonus entitlement if they do not currently have an existing VA mortgage and they have full basic entitlement.

Phone: 602.435.2149

Email: Team@JeremyHouse.com

Need help with the down payment? Veterans using a VA mortgage may have access to an Arizona down payment assistance program.