It’s easy to lose track of all the mortgage, real estate and economic data storms blowing across your radar. News headlines tend to be drafted based on what sells. Why not take a statistical approach to “what happens next”?

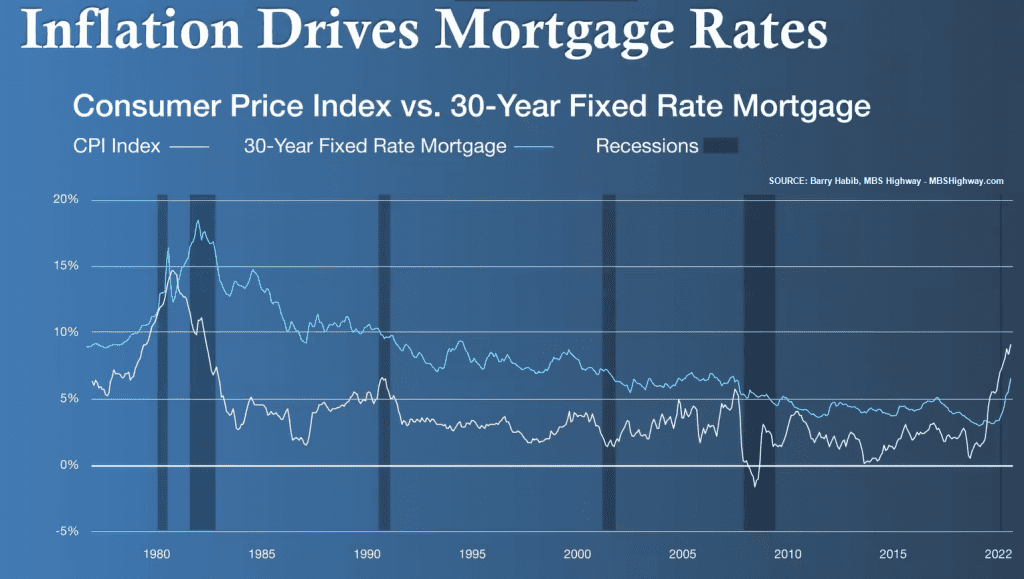

Inflation Drives Mortgages Rates

First and foremost lets establish a fundamental. Those who are not new to our blog already know inflation drives mortgage rates. While not the only driver, it is the primary one. Over time, mortgage rates and inflation travel along the same trend paths.

Many factors ultimately dictate mortgage rates however the overwhelmingly definitive and predictably related factor is inflation.

In periods of high inflation you see higher mortgage rates while lower inflation supports lower mortgage rates.

Currently, inflation is up. As you can see in the chart, mortgage rates followed suit and are up as well.

Will We See a Recession?

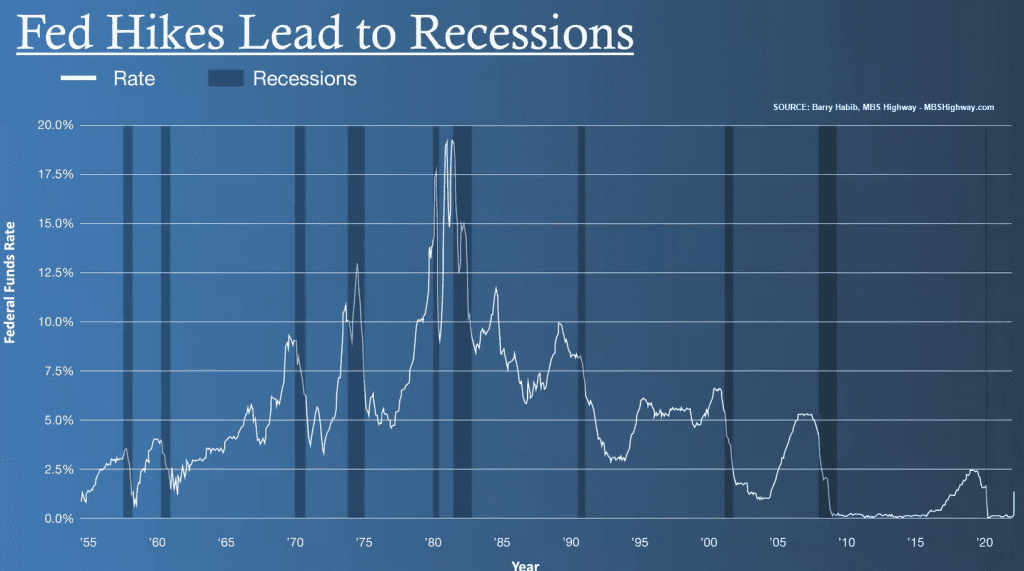

No crystal ball perfectly predicts this. However, judging from historical data the answer is – a recession is probably in our near future. After all, Fed rate hike cycles historically lead to recession. Further, Fed hike cycles tend to end when a recession begins.

Remember, a recession is a decline in economic activity. While the definition has changed recently it remains true that recession means widespread decline in economic activity.

Why do Fed rate hikes cause recessions? In short, the Fed hikes the Fed Funds Rate to slow the economy down to ease inflation. What inevitably occurs – the economy slows down into a crispy cool recession.

A “soft landing” would be ideal however, given the complexities and sheer size of the economy soft landings are rare – and that’s okay.

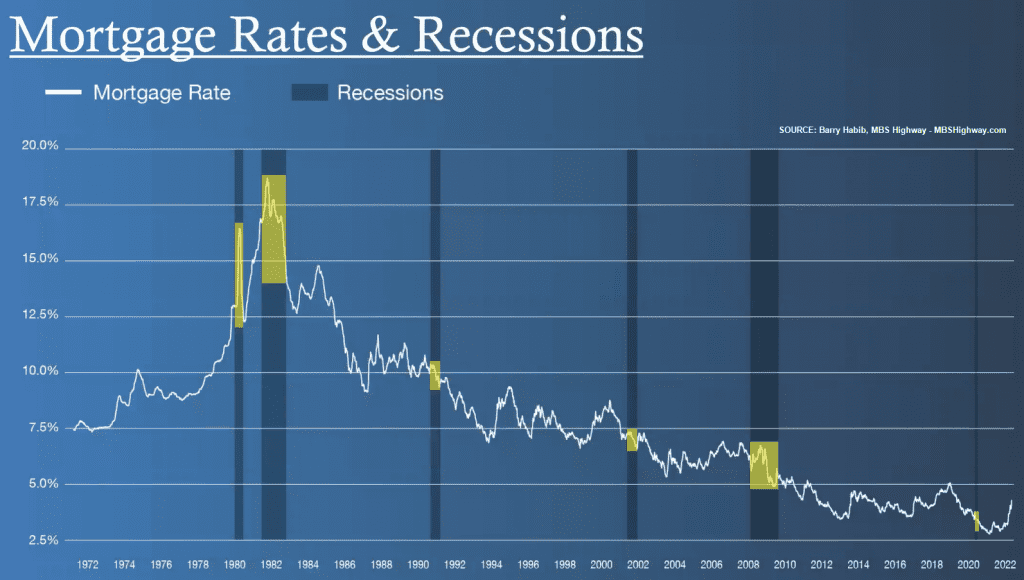

Mortgage Rates During and After Recessions

Now to main question #1 – how to mortgage rates react to a recession? Analyzing mortgage rate’s fondness for recessions can be done by looking at 3 basic facts.

- Recessions equal slow economic activity

- Slow economic activity typically means lower inflation

- Lower inflation typically means lower mortgage rates

Another way to handicap how rates fair through recessions is historical review. Historically speaking mortgage rates decline through recessions.

During each recession since 1980, mortgage rates declined during and after a recession. Again, many factors go into determining mortgage rates.

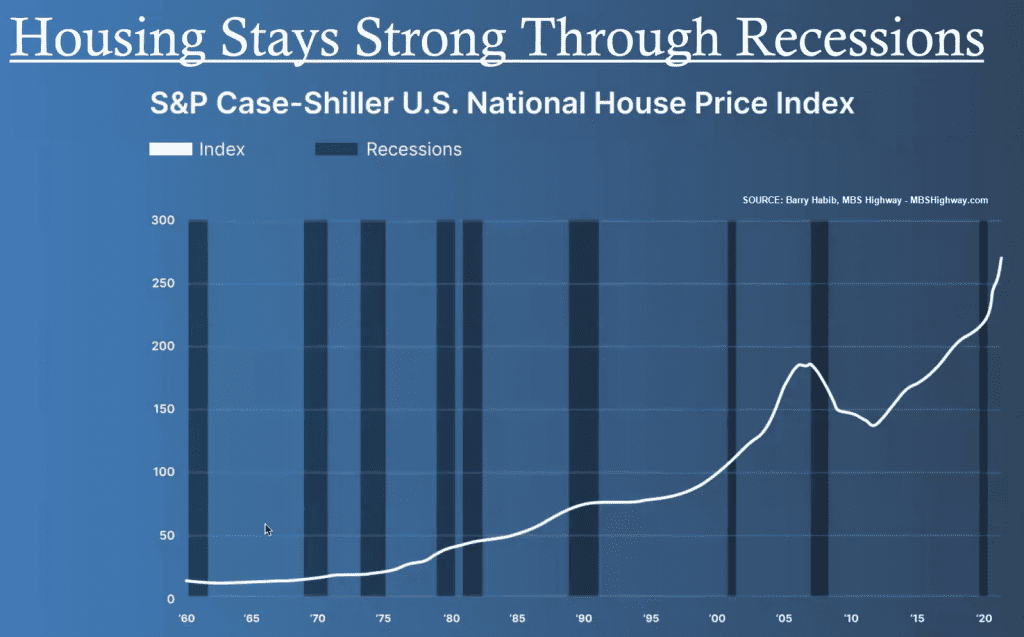

Home Values + Recession = ?

Finally, question #2 – what happens to home values during and after a recession? Just like mortgage rates, a host of factors play into the direction and velocity of home values. However, the same type of approach that helps gage rates and recessions helps in part shape expectations for home values relative to recessions.

Housing historically fairs well through recessions. The big exception is the housing crash and recession in the 2000’s.

The housing crash induced recession and sliding home values resulted in very large part from a massively deregulated mortgage and real estate industry. While no guarantees exist, the changes to the mortgage industry that came about after the housing crash

go a very long way in preventing such a meltdown from reoccurring. Pre-housing crash a borrower could get a mortgage where they do not pay the full interest each month, the unpaid interest is added to the monthly balance, put 0% down, have very poor credit and state what their income is to the lender. Post-housing crash borrowers must put money down, pay their full payment, have acceptable credit, fully document their income and more.

This sets up a very different dynamic in today’s housing market compared to the “ready to implode at first sign of trouble” housing market that existing in the early 2000’s.

Summing It All Up

Data and statistics are helpful indicators. Past performance doesn’t guarantee future performance. So yes, anything can happen with housing, mortgage rates and the economy. However, data like that shared in this article helps look at our current situation with more fact and less emotion.