Ever wonder what the “Aggregate Adjustment” on your loan estimate is for? Sure, it benefits you but you want to know more. For example:

- What is the vaguely named “Aggregate Adjustment”?

- Why do you receive it?

- Who pays for it?

Much like the rest of the home loan process, escrow accounts follow Federal Regulation. Lenders set up Escrow Accounts for buyers including property tax and homeowner’s insurance payments in their mortgage payment. The Escrow account collects and hold your funds ear marked for future property tax and homeowner’s insurance payments for your home. At the time your loan funded, your mortgage lender set this escrow account up for you.

Initial escrow account set up includes a few steps. For example, lenders initially collect money from you for the following:

- 1st year’s homeowner’s insurance premium

- Pro-rated property taxes

- Cushion for insurance and taxes to safeguard you against future cost increases

While the above is straight forward, you may wonder who regulates the amounts lenders collect from you for your initial escrow account set up?

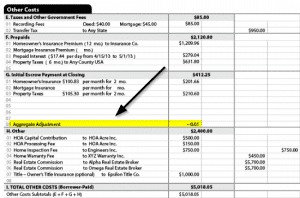

Aggregate Adjustment Limits Lenders

The mortgage police (AKA – the CFPB) keeps lenders in line in this post mortgage meltdown era. In fact, the CFPB enforces specific rules limiting the amount mortgage lenders collect to initially set up your escrow account. This is where the mysterious and often under explained Aggregate Adjustment on your loan estimate comes in.

At the onset, lenders collect funds from you based on standard calculations related to the following:

- Closing date and County property tax due dates

- Homeowner’s insurance premium total

- Specific number of months of cushion for taxes and insurance

Lender’s closing departments typically compute the amount collected for initial escrow account set up. While complex, the CFPB’s calculation for the maximum amount allowed to be collected has it beat. For those who love details, check out the exact language of the CFPB’s rules. For the rest, suffice it to say a lenders calculation of how much to collect for initial escrow account set up commonly exceeds what the CFPB allows. The mechanism used to account for this overage? You guessed it – the Aggregate Adjustment.

Aggregate Adjustment Credits You the Excess

In other words, think of the CFPB’s allowed amount as an empty 10 oz drinking glass. Your lender’s calculation of how much to collect for your initial escrow account is the water that must fit in the CFPB’s glass. Imagine your lender determines you should pay 12 oz of water. After pouring the 12 oz’s of water in the 10 oz drinking glass, 2 oz’s of water will spill over onto the counter. Why? Your lender collected 2 more oz’s of water than the CFPB allows. The result – an Aggregate Credit on your loan estimate equal to 2 oz given back to you.

Instead of oz’s of course this unfolds in real dollars. The amount your lender collects for your initial escrow account set up that exceeded the CFPB’s max allowable collection limit for your specific loan appears as an Aggregate Credit on your loan estimate. Most often, the Aggregate credit on your loan estimate lowers your overall cash required at closing.

By Jeremy House