Everyone knows credit is key and it impacts your Arizona home loan approval. Your Arizona mortgage lender pulls a tri-merge (all 3 bureaus) credit report for you. As a result, lenders typically have 3 credit scores for each borrower. However, what score matters most? How do lenders decide which of the 3 scores to use?

The 3 main credit bureaus are:

Credit scores represent what kind of risk you represent to a lender. Higher credit scores equal lower risk consumers. Lower credit scores equal higher risk consumers.

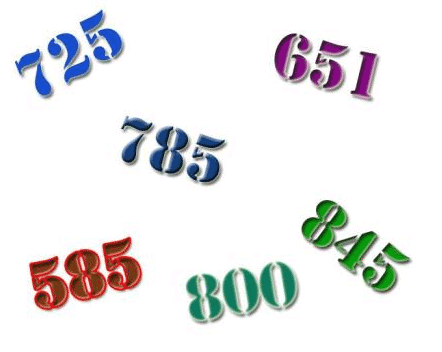

Of the 3 credit scores you have, Phoenix mortgage lender care only about your middle score. Lenders do not average your 3 credit scores. They pick the one in the middle.

For example, a borrower with a 680 Equifax, a 725 Experian and a 755 Trans Union score has a 725 middle score. Therefore, your lender uses 725 as your credit score. Also called your “loan score”, your middle credit score in part determines what programs you are eligible for and your home loan interest rate.

Why 3 Different Credit Scores?

The three major credit bureaus calculate a credit score differently. In other words, they each dissect and analyze data like payment history, account balances and derogatory accounts in their own way. As a result, each bureau is likely to show a different score for the same consumer.

In addition to 3 bureaus having 3 different scoring methods, different types of credit reports exist. For example, you have the following:

- Automotive

- Mortgage

- Consumer (CreditKarma etc..)

- Credit Card

In fact, there are over 51 different credit score calculations being used today. Ever wonder why credit scores often get referred to as “FICO score”? FICO is a company that pioneered the credit scoring game. These different credit score calculations are custom built and weigh information differently based upon what the use of the credit report.

For example, auto based credit reports should weigh previous auto loan payment history more than a credit card related credit report. Different industries utilize specialized credit reports to minimize risk and maximize profits. In conclusion, there are many variations of your credit score. Credit is a valuable and accurate measurement of credit risk in most situations.

By Jeremy House